Welcome to the quick-hitting newsletter about Cardano, Crypto Trading, Blockchain, Monetary Policy, & Data Privacy.

I hope you enjoy this newsletter and that it provides some perspective on the massive paradigm shifts happening in front of our eyes. If you enjoy it, please share it with others when you get to the end!

Quote of the Day

“I sincerely believe that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity under the name of funding is but swindling futurity on a large scale.”

― Thomas Jefferson to John Taylor, 1816

The founding fathers talked in language that many of us don’t understand these days. What was Jefferson really saying?

How can banks be more dangerous than standing armies!? If they spend money they don’t have, that future generations need to pay back with interest, that’s how! Doing so effectively swindles (steals from) our children and grandchildren’s future.

Whether or not this should be done is a philosophical or moral discussion. The fact of the matter is that it IS HAPPENING RIGHT NOW.

Today’s newsletter is sponsored by Cardano Dan’s Stake Pool & my partner Reliable Staking.

Our Cardano stake pools provide high performance and low fees. We greatly value your support!

RELY on Reliable Staking & Cardano DAN2 grow your ADA!

In the News

Case in point. The ink hasn’t even dried on the $1.9 Trillion Stimulus package and attention has turned to an EVEN BIGGER $2-4 Trillion Infrastructure Bill (estimates vary depending on the source).

Most of this money is deficit spending contributing to more and more national debt.

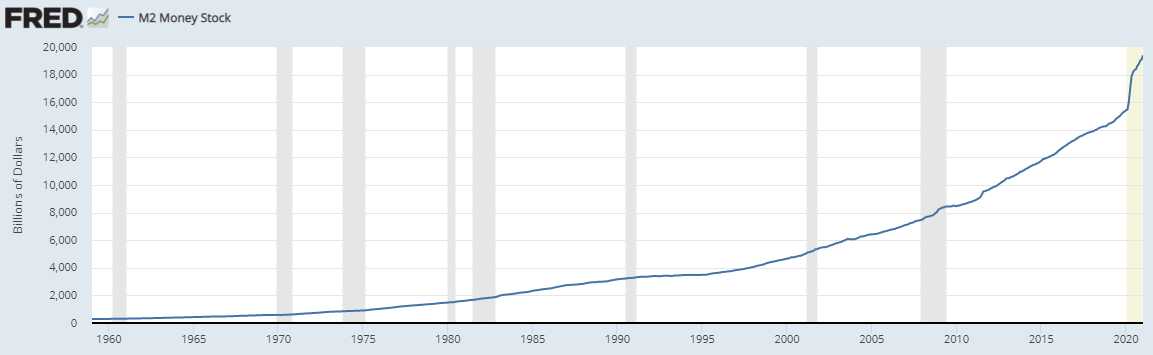

How do you spend money you don’t have? By printing it. Here’s a chart showing the increase in M2 Money Stock from the Fed.

Deeper Insight

So what does this mean for you and what can you do about it? It means that even if the official CPI numbers aren’t showing it, inflation has already arrived.

Why aren’t the official CPI numbers showing it? The way that CPI is calculated was changed many years ago, hiding inflation. I leave it to you to assess whether or not that was intentional.

Check out this image that shows what CPI would currently look like if the calculation wasn’t changed.

Michael Burry made big news recently talking about his expectations for coming hyperinflation. In case you don’t know who Michael Burry is, let me tell you. He’s the guy that predicted the Housing Crisis.

In the end, all of this money printing leads to the destruction of fiat currencies. If you’re subscribed to my newsletter, you probably already get that, at least to some extent.

Let me encourage you to learn even more by digging into these two great threads from two of the smartest minds in this space.

The TLDR version of these threads is:

Because the money supply is going up, everything is going up.

You can no therefore no longer measure returns according to the USD. It is the wrong denominator.

Central Bank balance sheets need to be considered when evaluating returns.

Raoul and Preston conclude that Bitcoin has been and will be the superior investment in this context. They compare Bitcoin’s performance to all other asset classes as part of this analysis.

I would add that Cardano ADA has outperformed Bitcoin since the March lows last year. Here’s the performance of all crypto majors compared to stocks and metals last year.

Cardano Nugget

Cardano’s sound monetary policy is important to understand when considering it as an investment alternative to Bitcoin.

Cardano models Bitcoin’s monetary policy in many ways. It has many of the same properties that make Bitcoin attractive as a store of value - maximum supply and halving approximately every 4 years.

I recommend you read more about Cardano’s important parameters driving monetary policy and decentralization and likely updates that are coming to those parameters in the future.

Technical Analysis

I tweeted yesterday

Here’s why I said this. This is intermediate analysis (it’s not for day trading. In other words, I’m NOT trying to predict EXACTLY when the spring is going to release, rather the direction when it does)

4 hour RSI is entering back into oversold levels

Overnight, we broke below the .618 fib retracement level, but I don’t expect to remain below that level long

We have a prototypical set of fan trendlines. The breaking of the third trendline usually signals the upside trend reversal (we could see a retest of the 2nd line but I doubt we drop that far)

We tested an important high from a previous move and saw a strong bounce off of that (see green horizontal trendline). This level may see a retest again. It’s close to the .786 fib retracement level which will serve as support too.

Volume has been declining on the pullback and spiking on the break of the fan trendlines

Volume is normally strong in the direction of the trend

BTC & ETH pairs continue to hold important support levels

Additionally, we’re still expecting big fundamental news over the coming weeks and month.

Tell Me What You Think

What do you think? I’d love to hear your thoughts, questions, and feedback below!

This newsletter is for entertainment and educational purposes. I’m not a financial advisor and you should do your own research and consult a financial advisor before investing in cryptocurrencies.

I was comparing with the bar pattern of ADABTC pair of last June to September, there are some similarities.

If we follow it exactly, we may have a bounce first and have some more drops later until April. But I agree ADA is at some important supports, hope it get the upward momentum soon.