Quote of the Day

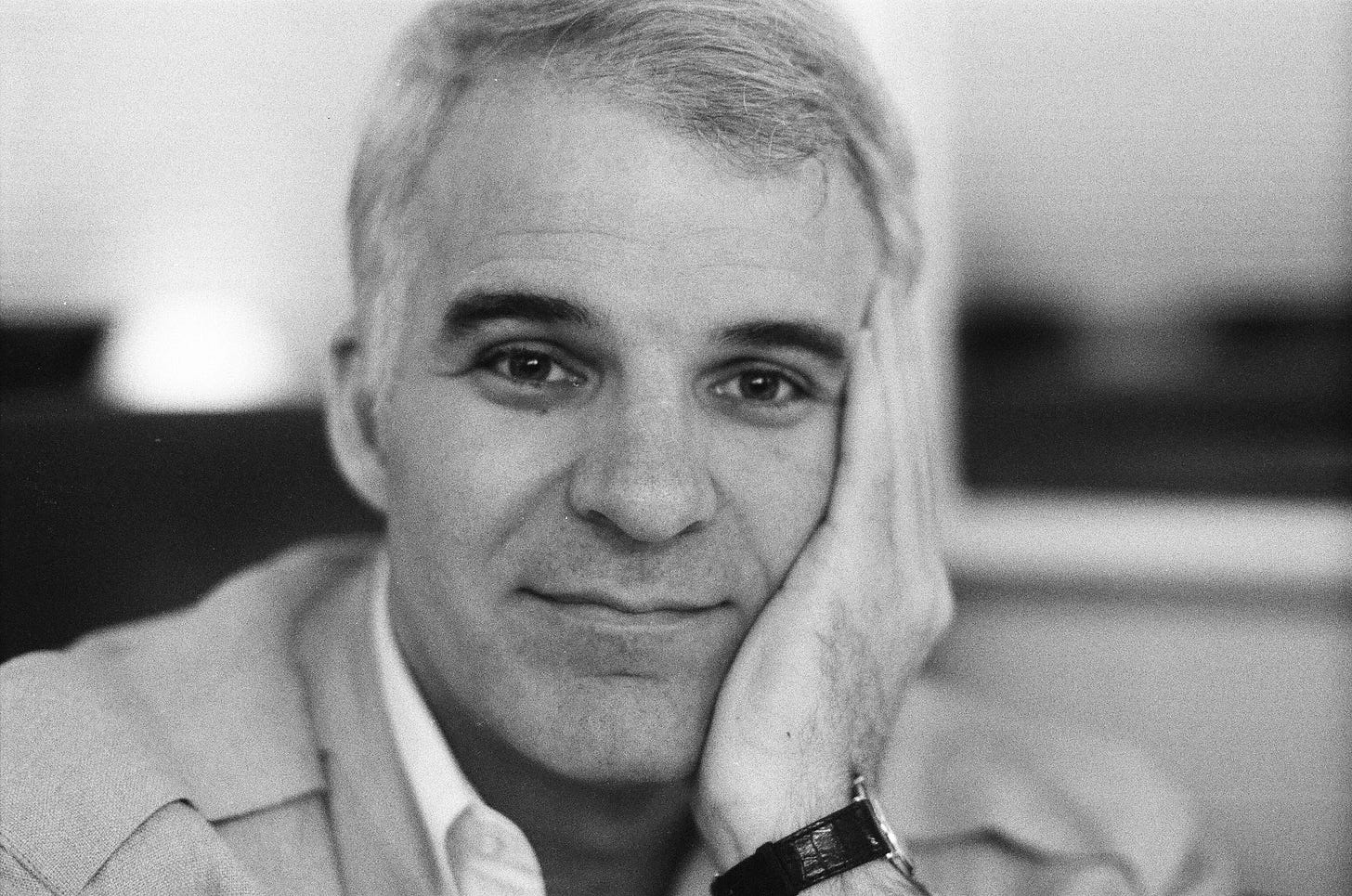

“Be so good they can't ignore you.”

― Steve Martin

So much hate coming at Cardano. So many haters. You can focus on the negativity, or you can focus on the positive side of it.

I’ve personally experienced a lot of opposition in my life. It’s no fun. It’s hard. It’s stressful. And a lot of other things.

But you know what, sometimes, in fact many times, it can reflect something good. Often times, criticism and hate is coming from people that are negative people, whose way of life is challenged by the positive change you’re trying to implement.

If that change is good, people can’t ignore it. They’ll have to make a decision about what to do about it, but ignoring it is not an option. So be good.

In The News

There are major geopolitical shifts taking place that few understand. It is kind of scary how big the changes really are. The world is changing and you should be paying attention.

There are protests around the world over vaccine mandates for work, shopping, entertainment, school, and more. France is one example.

I think I’m a little bit of an enigma when it comes to all of the COVID stuff. I’m vaccinated but don’t believe people should be forced to be in order to be part of society like everyone else.

I also take issue with people trying to insist “science” justifies their opinion. I agree with Pomp on this topic.

Vaccine mandates and COVID will continue to be very big news items and drivers of economic activity that you should keep in mind as you make investment decisions looking weeks and months into the future.

Cardano Updates

Related to the quote of the day… yesterday, a ton of FUD broke out about Cardano’s ability to handle concurrency. IT IS FUD. There have been a number of quality responses to it. Here’s one.

Charles streamed a longer response that I believe will become the 2021 sequel to the 2017 whiteboard video.

It’s hard for me to understand how someone can listen to this and think that Cardano is a scam and Charles is charlatan. It’s my opinion that the longer people take that stance, the more likely it is they end up sounding like this in the future.

Technical Analysis / Price Discussion

I’ve said a number of times that I think we’re in the 5th wave of an Elliott Wave cycle in crypto markets.

If you zoom out and look at weekly charts and weekly RSI, you can see some interesting things. Wave 1 peaked the week of July 20th around 83.5. Wave 3 RSI peaked at almost 95 (!!!) but then ADA continued higher to $2.47 but with a lower RSI of about 83.5 again.

I think it’s reasonable to expect that we will see at least 83.5 RSI on the weekly charts again before the end of this bull run. I actually think it will be higher than that. We’re currently at about 74.5.

When in doubt, zoom out.

This newsletter is for entertainment and educational purposes. I’m not a financial advisor and you should do your own research and consult a financial advisor before investing in cryptocurrencies.

Can you explain the TradingView chart settings for the RSI chart? Trying to duplicate but having no luck. Or do you share the charts on TradingView somewhere?