Quote of the Day

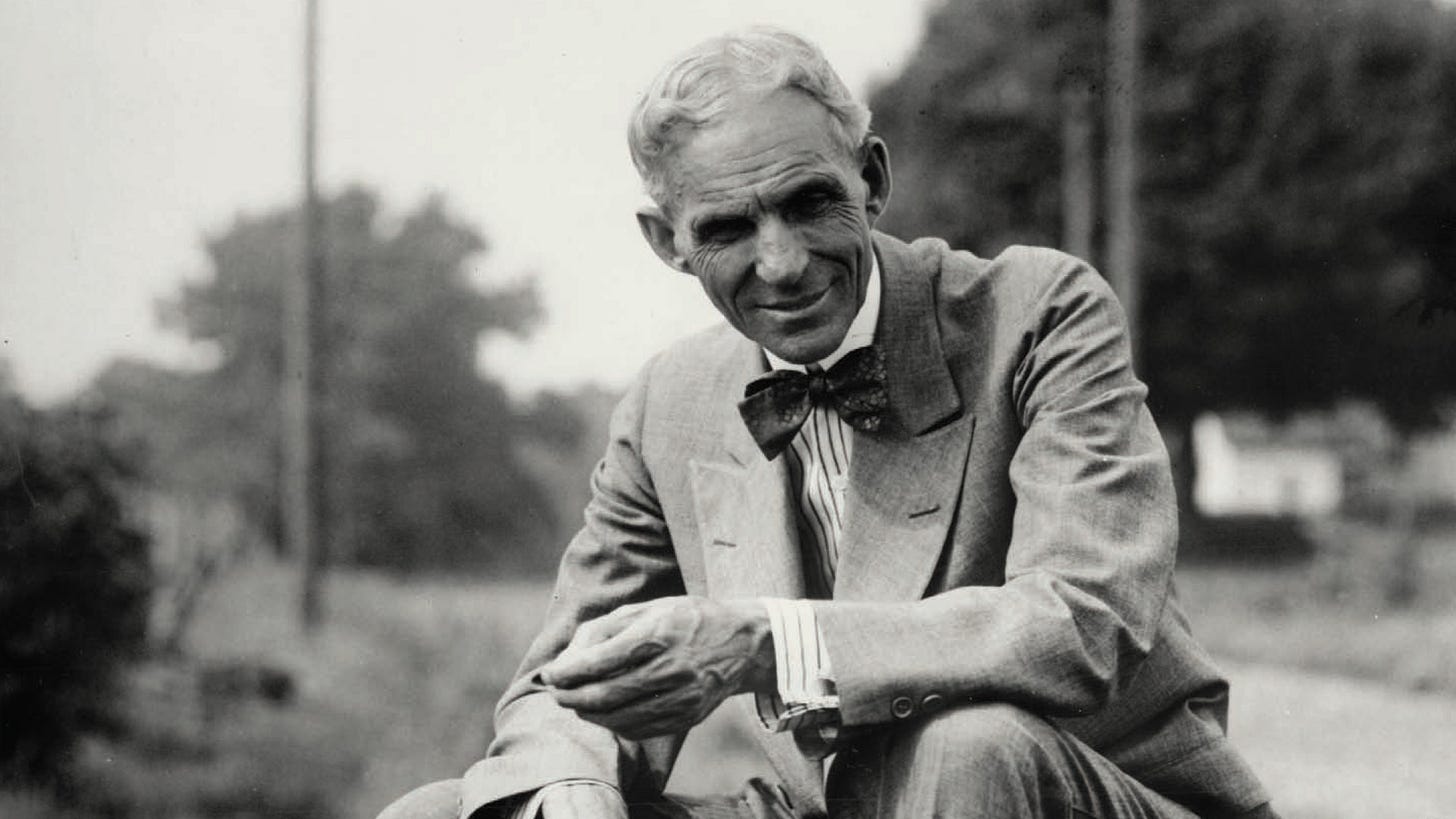

“Don’t find fault, find a remedy; anybody can complain.”

― Henry Ford

We all run into issues and problems every day that make us want to complain. And who can really blame us? There’s a lot to complain about and it sometimes feels good to vent.

But complaining is the easy path. And if you do too much of it, you’ll find that people don’t really want to be around you much. You know who people do want to be around? Problem-solvers. So next time you run into a problem, find a remedy. It will make you and the people around you feel better and be better.

In The News

The Fed freaked out markets yesterday with the release of hawkish meeting minutes. I don’t think we’ll ever see this hawkish scenario come to pass because even the whiff of it happening is freaking markets out and will force the Fed to adjust course before it ever happens. That’s my thinking anyway.

LinksDAO sold a collection of NFTs as a step towards buying a real-life golf course. The DAO will be doing a token airdrop of LINKS tokens in 2022 (not to be confused with LINK - yeah right, thanks). The world of NFTs is still just getting started.

Cardano Updates

Samsung announced this week that it is planning to plant 2 million trees and track their planting with Veritree which is built on Cardano!

The Zombie Hunters news continues to flow along with another giveaway opportunity below!

Most NFT project create a just square ProFile Pic (PFP) image. We decided to up the game and include more than one image in the upcoming Zombie Hunters NFT drop! Each NFT will have a normal square image AND a wider image that includes Zombie Hunter SWAG and a to be announced addition!

Technical Analysis / Price Discussion

As described above, the Fed nuked markets today and that includes crypto markets.

Cardano ADA is testing important support levels as we speak. I don’t care for how things look. The same trendline is being tested again and trendlines fail after too many tests. A “death cross” happened about a month ago, and ADA is risking a break below the Point of Control on the Volume Profile.

On the flip side, I know that often times when I don’t like how things look, it’s just before a turn-around. The hypothesis that we’re still in a bull market is being tested to its limits. I’m still a bull market believer and think we could be close to capitulation in the current move down with a fake-out break below the trendline.

It’s very hard to say and we shall see what happens after the markets are done digesting this most recent Fed news. I wouldn’t be surprised to hear some dovish comments from Fed officials over the coming days that lift markets. Something like, “Omicron trends could force us to slow the plans discussed at the last meeting.”

This newsletter is for entertainment and educational purposes. I’m not a financial advisor and you should do your own research and consult a financial advisor before investing in cryptocurrencies.

🙏🇦🇹🙏