Welcome to the quick-hitting newsletter about Cardano, Crypto Trading, Blockchain, Monetary Policy, & Data Privacy.

I write my newsletters the way I like to receive information. Quick-hitting and to the point. I value your time just as much as you do. I seek to arm you with valuable and important news in the shortest period of time possible.

I hope you enjoy this newsletter and that it gets your planning juices flowing. If you enjoy it, please share it with others when you get to the end!

Quote of the Day

In the words of the famous Mike Tyson

This is so true. A good punch in the mouth will mess you up good. Crypto has a tendency to punch a lot of people in the mouth. And it punches hard.

Even with a plan in place, crypto will mess you up. Without a plan, you’re as good as bankrupt and have a better chance making money gambling then you do with crypto.

So with that being said… you should have a plan!

Today’s newsletter is sponsored by Cardano Dan’s Stake Pool & my partner Reliable Staking.

Our Cardano stake pools provide high performance and low fees. We greatly value your support!

RELY on Reliable Staking & Cardano DAN2 grow your ADA!

Cardano Nuggets

Cardano has a monetary policy plan. There will never be more than the maximum supply of 45 Billion ada. There are currently ~32 Billion ada in circulating supply of which ~72% are staked and earning staking rewards of ~5% ada APR.

In the News

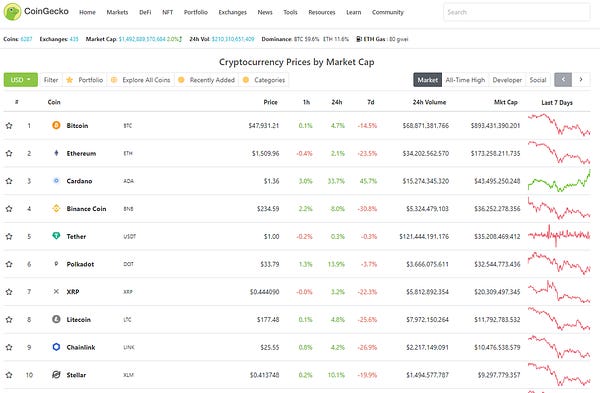

You probably already know this, but Cardano’s been on quite a run lately. Ada is now the 3rd most valuable cryptocurrency by market cap behind only Bitcoin and Ethereum.

Here’s a recent snapshot of the performance of the top 10 cryptocurrencies. At the time, Cardano was the only cryptocurrency in the green in the prior 7 days.

This distinct performance is the direct result of the Cardano development team’s push to incrementally deploy Goguen on the Cardano Mainnet. Native assets are going live TODAY as part of the Mary update.

This performance has made a lot of people start wondering, “Should I be taking profits?” Well that depends who you are and why you own ada!

Around the Block

Charles Hoskinson recently recorded an interview for Real Vision Crypto that’s going to be released soon. I encourage you all to watch it, I know I will.

Not everyone owns ada. A lot of folks that JUST own Bitcoin or Ethereum (when you only own one cryptocurrency you’re called a maximalist) are starting to feel a little threatened because of Cardano’s performance.

Raoul Pal, the founder of Real Vision, has taken HUGE amounts of grief for interviewing the co-founder of the 3rd biggest cryptocurrency project. Stop and ask yourself if that makes sense.

To Raoul’s credit, he’s not backing down and pushing back against the hypocrisy in the space.

Investing Angle

Ok, so you’ve made it through maximalism, you’re invested in some cryptocurrency including Cardano ada. Should you buy more or should you sell what you have? This is the most common question prominent voices get on Twitter.

Well first of all, no one can tell you when to buy or sell. But second of all, I ask in return, what are your objectives? You should come up with a plan to meet your objectives. Objectives generally revolve around your timeframe for taking profits.

Some of the most common timeframes for profit taking and their associated trading/investing techniques:

Day Trading - Getting in and out of trades the same day

Swing Trading - Trying to profit off of short-term trends

Position or Trend Trading - Looking to take advantage of larger trends on the order of months or years.

Long-term Investing - This is HODLing. Holding for the foreseeable future without any plans to sell.

Do you know what category you fall into with your crypto portfolio? You don’t need to pick just 1, but you should have an idea of how to segregate your investments so that you can develop and execute an intentional plan for each.

Here’s an example of how you could allocate your crypto portfolio into these timeframes.

Day Trading - 0%

Swing Trading - 10%

Positing/Trend Trading - 25%

Long-Term Investing - 65%

This is an example that many people could build a plan on top of. Most people don’t have the time, interest, nerves or technical savvy to day trade. It’s quite risky and has REKT many aspiring crypto traders.

Looking at the other timeframes, there are many reasons to break your portfolio into multiple time horizons like this:

It creates the opportunity to take advantage of projects that are moving

It allows you to invest long-term in the projects you really believe in

It diversifies your strategy so that if you perform poorly in one area, you can do better in another

It helps you identify which of these areas fits your skills and lifestyle the best

So you own some crypto and want to know whether you should buy or sell. Do you know what your timeframes are? Let me encourage you, if you don’t have a plan. Start with this. Figure out what you’re doing with your crypto and what timeframes you’re working within. It’s an important first step in an intentional crypto investing/trading strategy.

Analysis

Last night, Cardano ADA closed out the day, week, and month of February strong.

Here’s the monthly log view after the close.

Some thoughts on the monthly chart:

Ada established new all time highs.

Ada established a new monthly closing high.

The month closed with a healthy full candle near the top of the month’s range.

Volume is increasing.

(on a side note, ada USD calculated charts on Binance do this weird thing where they show the 2018 high as 1.40 when looking at any timeframe over 4 hours, but show the correct high of 1.319 when you look at 4 hours or below)

It’s hard to imagine that ada keeps going this strong without pausing. There’s been a lot of rumored news and generally crypto is a “buy the rumor, sell the news” kind of place. As an example, ada had a really strong run up to the launch of Shelley last summer and then saw a few month pause after the launch. We could see the same thing here.

On the other hand, I truly believe there are fundamental reasons that Cardano ada could keep right on running. The coming updates to Cardano include such game-changing capabilities and user experience improvements that I think it’s a real gamble to bank on a pause or pullback right now. Add on top of that fundamental analysis that we’re in the midst of a massive cryptocurrency bull run and I’m not inclined to play games with positions at this moment.

Tell Me What You Think

Comments have been turned on for this post. I’d love to hear your thoughts, questions, and feedback below!

This newsletter is for entertainment and educational purposes. I’m not a financial advisor and you should do your own research and consult a financial advisor before investing in cryptocurrencies.

Glad to be apart of the cardano community, got into Cardano about a month back, fell in love with the ecosystem and the project. Even as a newbie I figured out the staking ASAP and will continue adding my ADA to it every week. I have found myself focusing on ADA and doing it long term I dont see selling ADA as an option once I have ADA that’s my currency to hold and save , or stake in a delegation.

This is great dan! Amazing work! Will be staking with you and happy to be reading this regularly!