Quote of the Day

"When you reach the end of your rope, tie a knot in it and hang on."

— Franklin D. Roosevelt

A lot of folks that are new to crypto probably felt like they reached the end of their rope on Wednesday. It’s understandable.

I’ve been investing in crypto since early-mid 2017 and aware/around it before then. I share this as context. I saw the run up to $20,000 Bitcoin and the related altcoin frenzy. I also saw and experienced the aftermath and 95-98% losses that many experienced from the peak in early 2018 to the lows in March of 2020.

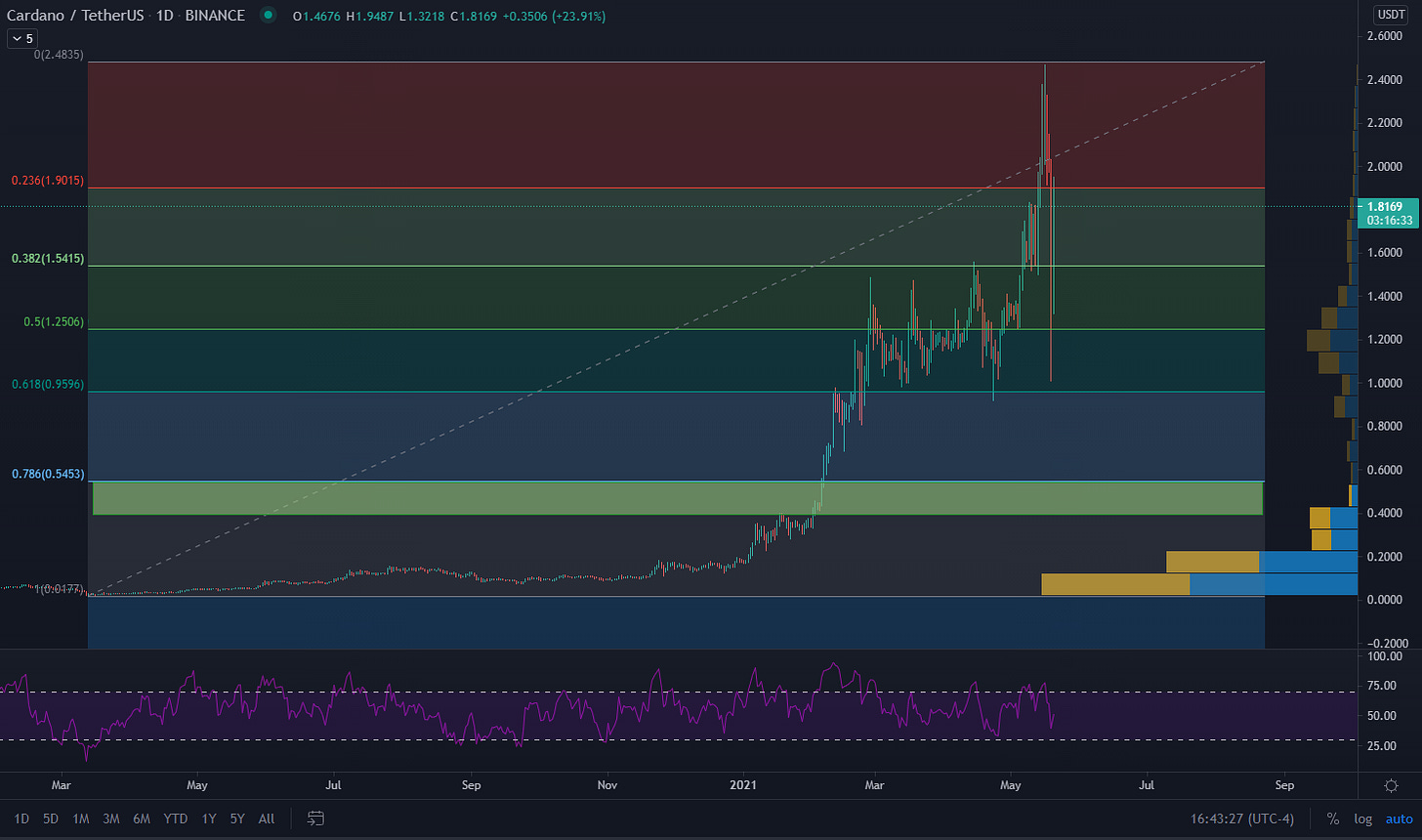

The thing you come to appreciate once you’ve been in crypto a while is that, even during a bull run, large pullbacks are normal. Here are all of the 30%+ pullbacks for ADA since the March 2020 lows. There have been NINE so far.

These pullbacks are VERY difficult to experience for the first few times. When they’re larger than the normal ones they’re even more difficult.

If you’re convinced that the technology will change the world, you’re investing for the long-term, you’re not using leverage, and you’ve only invested what you can afford to lose… then the best advice when you reach the end of your rope is “tie a knot in it and hang on.” Let me encourage you, once you’ve done it once or twice, it gets easier.

In The News

It’s been an eventful couple of days in the news!

Most people attributed the major cryptocurrency pullback to news coming out of China that regulators moved to ban banks and payment companies from offering crypto-related services.

There’s FUD like this every so often, but nothing about this particular news seemed game-changing to me.

People overreacted again 24 hours later when news hit that the Treasury was calling for large crypto transfers to be reported to the IRS.

More FUD. This doesn’t really change anything. The vast majority of people using cryptocurrencies are following the appropriate laws and this news is a non-event for them.

It can be difficult to assess news events like this in real-time, so it’s best not to panic and to take time to digest what’s really happening before making any rash decisions.

Cardano Updates

Charles shared in his most recent AMA that IOG will announce when and where the Goguen Summit is going to be at the end of the month!

Jack Dorsey shared his thoughts on Proof of Stake on twitter. Always remember the “hidden agendas” that I discussed a few newsletters back.

This will be a recurring theme, especially as it relates to energy consumption and Bitcoin maximalists’ refusal to consider Proof of Stake.

IMHO, well constructed POS protocols are just as decentralized as Bitcoin while using a tiny fraction of the energy that Bitcoin uses. Maximalists need an argument beyond just, “we love our coin” because … if you could do the same thing with way less energy, why wouldn’t you?

Technical Analysis

Now we get to your favorite section! Although I did give you a chart in the main section today too! :-)

Where are we headed!? I think it’s up, but let’s evaluate both possibilities, looking at down first. If we were to head down, I would see $.40-$.50 as the next support level. That represents:

.786 fib retracement from the full move, low to high, since March 2020 lows

the next highest area of volume that’s been put in below the area at $1 that was just tested

However, I find that very unlikely at this time. Everything I see tells me that the bull run is still very much alive and well.

While we experienced an extreme pullback, my call from prior newsletters remains the most likely path forward to me.

The most recent run from $.92 to $2.47 and then back to $1.01 give us three really clear points to work with for a trend-based fib extension (shown below) Also:

Daily RSI saw significant relief from an overbought condition

There is REALLY STRONG support at $1 that ADA bounded off

There are SO MANY big news events coming in the Cardano ecosystem with the launch of Goguen and SO MANY things being built that the markets REALLY WANT

I see ADA targeting the 1.618 fib extension sooner rather than later.

What do you think? Am I nuts to stick with my call?

Do you know anyone that would benefit from my newsletter? Please share it with them today!

This newsletter is for entertainment and educational purposes. I’m not a financial advisor and you should do your own research and consult a financial advisor before investing in cryptocurrencies.

$1 seems a strong buy wall, the rebound from $1.01 suggest that many order front run the $1 support in order to get filled in case of the dip.