Quote of the Day

“Never tell me the odds!”

— Han Solo

I started investing and trading crypto in 2017 after several years of following it from a distance.

I got heavily involved in 2018 and 2019 in the midst of “crypto winter.” At the time I began getting really serious about crypto and Cardano, most people thought I was nuts and that the odds were heavily stacked against me.

I ignored all of them and, like Han Solo, forged ahead anyway. I’m doing a similar thing now.

Lots of people think that the bull run is over. I don’t. Could it be? Sure. But I don’t want to hear anyone else’s “odds” because I’ve done my own analysis and I’m sticking with it. You should do your own analysis and then make your move too. Don’t let anyone else tell you what to do based on their odds.

Key Takeaways from the Past Week

Monday - Courage & Readiness

On Monday, we honored the courageous people of the world who are willing to serve and sacrifice for a cause great than themselves.

Wednesday - Other People's Money

Mid-week, we took stock of why private money is a good alternative to the direction of public money even in the midst of a clear push for regulation of cryptocurrencies.

Friday - Life in Your Years

On Friday we talked about how valuable time really is and encouraged making the most of whatever time we have.

Technical Analysis

I decided to look at things from a slightly different angle for this week’s summary newsletter. Here’s a channel (in log view) since the March 2020 lows.

Three key areas here are top of channel (~$3), middle of channel (~$1.20) and bottom of channel (~$.50).

My personal expectation is a move to the top of the channel very soon. This lines up with other analysis I’ve done.

Bottom of the channel is very unlikely in my opinion, but not a scenario that should be entirely discounted.

I’ve talked about buying $.90 - $1.00 if ADA drops to there again, but I’ll probably raise the top of that buy range to $1.20 based on this new view. However, I’m not expecting we see these prices either.

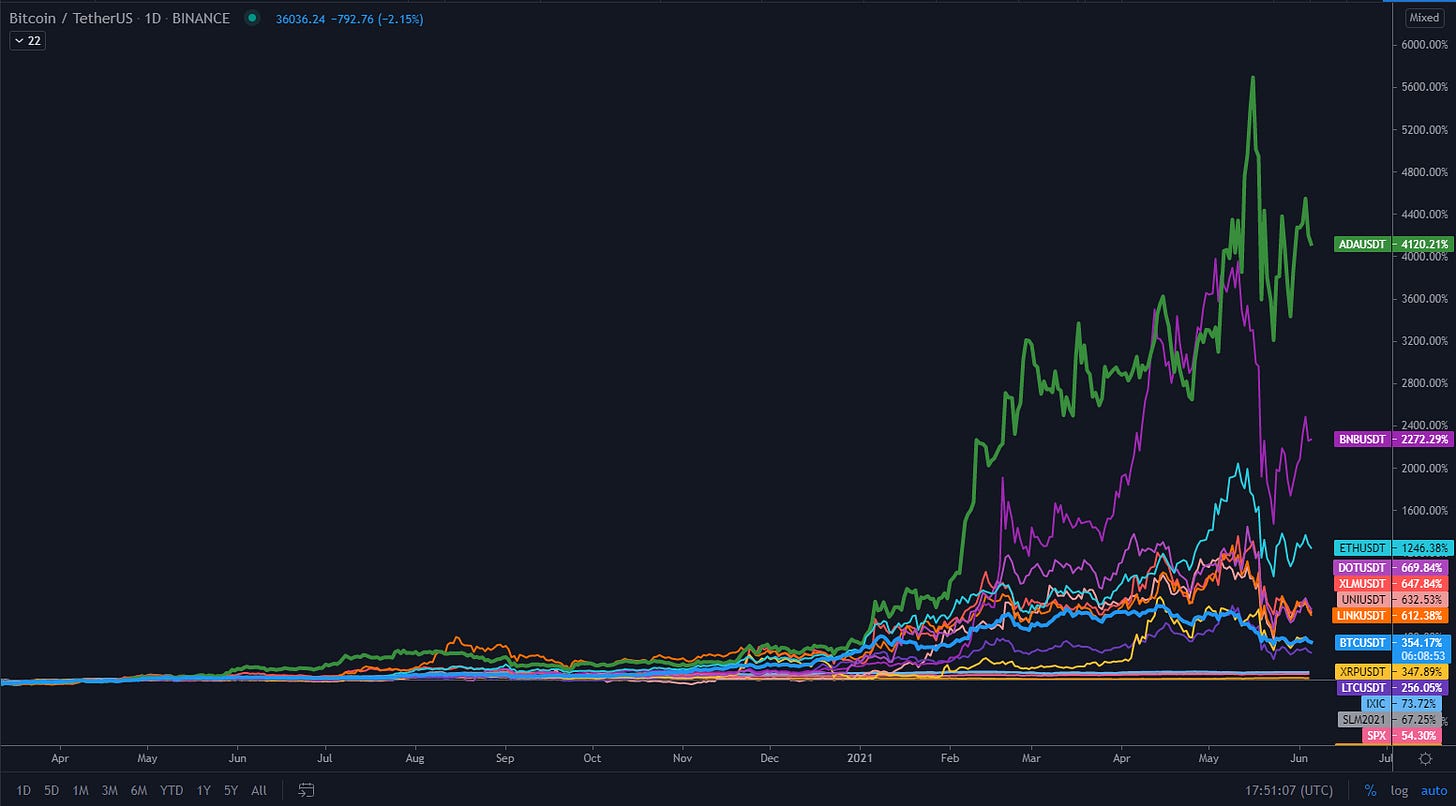

Looking at the crypto majors performance since March 2020 lows…

Cardano ADA continues to be in a league of its own. As we get closer and closer to the Alonzo event and the release of smart contracts, I expect this lead to grow too.

Finally we look at our Bitcoin and Ethereum comparisons.

As mentioned last week, I’ve updated this chart to used market cap ratios instead of price pairings. This is important not just because of the upcoming ETH token burns beginning in July but also because of different rates of monetary expansion between Bitcoin and Cardano.

Cardano ADA is not very far away from “market cap” discovery… if / when it breaks above it’s all time market cap ratios against Bitcoin and Ethereum, things will get really fun.

While we remain in a slow time / consolidation period, I don’t expect that to last much longer. I’m keeping an eye on the regulation, fiscal, and monetary policy news as potential headwinds. Other than those potential events, I expect the end of consolidation to result in the next (and maybe last) major push higher in this bull cycle.

That’s it for the weekly recap. Hope you all have a great rest of your weekend!

Before You Go

Do you like my newsletter? If so, please share it with your friends and family!

Comments are turned on for this post. I’d love to hear your thoughts, questions, feedback, and reflections below!

This newsletter is for entertainment and educational purposes. I’m not a financial advisor and you should do your own research and consult a financial advisor before investing in cryptocurrencies