Welcome to the quick-hitting newsletter about Cardano, Crypto Trading, Blockchain, Monetary Policy, & Data Privacy.

I hope you enjoy this newsletter and that it prompts you to get even more intentional with your planning. If you enjoy it, please share it with others when you get to the end!

Quote of the Day

"With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future."

— Carlos Slim Helu

Cardano Nuggets

Did you know you can switch stake pool delegations at any time without losing rewards? Just delegate to a new pool right from your existing wallet. It’s as simple as that. You’ll continue receiving rewards from your prior pool until you begin receiving rewards from your new pool in 15-20 days.

Do proceed with caution. If you deregister your staking key or move your ada to a new wallet, you risk losing the next few epochs of rewards from your prior pool.

Now that your armed with this knowledge, please consider delegating to DAN2 or RELY!

Today’s newsletter is sponsored by Cardano Dan’s Stake Pool & my partner Reliable Staking.

Our Cardano stake pools provide high performance and low fees. We greatly value your support!

RELY on Reliable Staking & Cardano DAN2 grow your ADA!

Investing Nuggets

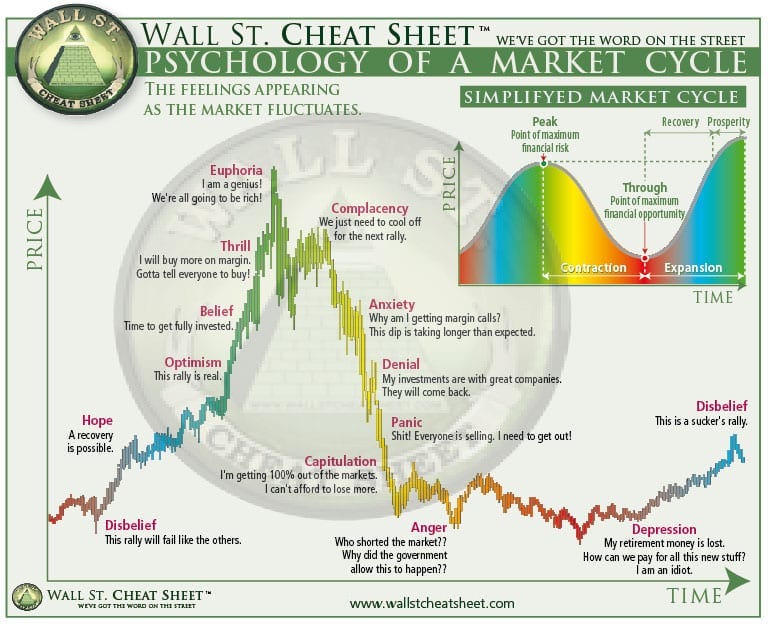

Markets have cycles. The following image is pretty common in investing circles. It explains the psychology of market cycles. These repeat over and over again. It’s fairly self explanatory, so I won’t go describe it in more detail. If you haven’t seen it before, take some time to digest it.

I think we’re somewhere around the “Optimism” feeling of the current cryptocurrency market cycle.

If you want to understand more about why cycles happen and how they connect to the economy, I highly recommend this outstanding video by Ray Dalio.

In the News

The Senate approved President Biden’s $1.9 trillion coronavirus relief package on Saturday.

Many Americans will begin receiving $1,400 (per person) stimulus checks as early as the weekend of March 13th.

I’m willing to bet that a large portion of the stimulus checks will make their way into cryptocurrencies. Here’s some pretty eye-opening context about how much ada each of the stimulus checks has bought.

Targets

Last week we talked about why it’s important to have a plan. The first step in having a cryptocurrency investing plan is knowing your time preference - how long are you investing?

Here’s an example I shared last week of how someone might allocate their crypto portfolio into timeframes.

Day Trading - 0%

Swing Trading - 10%

Positing/Trend Trading - 25%

Long-Term Investing - 65%

Targets are an important part of Swing Trading or Trend Trading.

So let’s say you have 25% of your portfolio allocated to trading the cycle. Let me ask you a question… did you buy Cardano ADA at $.02? If your answer is “No” then you missed buying the exact bottom of the cycle.

I’m going to assume you missed the bottom. If you didn’t buy the exact bottom, you likely won’t sell the exact top either.

Let’s use the 2018 Cardano ADA top as an example. Ada topped out at $1.319 in 2018. At that time, you had a total of 24 hours to sell ada above $1.20. And you had a total of less than 5 days to sell it above $1.

This is why you should use targets. Targets let you allocate the Trend Trading portion of your portfolio to specific areas ahead of time where you’ll exit your position, one piece at a time. As markets approach those levels, you can have orders in waiting for them to hit.

Targets allow you to allocate your trading portfolio into different targets that each have different probabilities of being reached, and therefore different risk levels.

Back to your 25% allocation. You can break that into 3, 4, 5 or more targets where you’ll take profit. I’ve identified a collection of targets for this cycle and I’m going to share my 1st target with you today.

1st Target

The following target relates specifically to Trend Trading THE CURRENT CYCLE.

Here are some data points I used for picking this target:

It’s important that this target be low risk and have a high likelihood of being reached because it is my 1st target for ada this cycle

THIS cycle, Cardano $ADA has already seen a ~75x from cycle low (~$.02) to recent high ($1.49)

Cardano’s technical progress is picking up momentum and by reaching the third place in the cryptocurrency market cap rankings recently, I believe it is quite fair to do market cap comparison’s between the two projects

I think it’s reasonable to hypothesize the Cardano can reach this cycle, the same level that Ethereum’s market cap reached as a high last cycle

Let’s use this hypothesis to calculate a target:

Ethereum topped out in 2018 with a market cap of ~$146B

At the time of this writing, ada’s price is ~$1.11 equating to a market cap of roughly $35.4B

Using some basic math, these figures can be used to calculate a target of $4.58 ada

Now, let’s do some critical analysis of our target. Remember, I want a high degree of confidence of hitting this target.

$4.58 is ~4.1x increase from the current price of $1.11

Cardano ada has already seen a 75x increase this cycle. Based on where I think we are in the cycle (mentioned earlier and informed by other folks as well), this seems more than reasonable

Is there fundamental news to support a continued price appreciation like this? With Goguen, Grayscale, Africa, and Coinbase all on the horizon, I think yes as well

1st Target Adjustment

With all of that being said, I want this target to be HIGH CONFIDENCE. I want to be absolutely sure I take at least some profits during this cycle

Also, as a part of the Cardano monetary policy, new ada are being created each Epoch to distribute as rewards and to the treasury and these ada will contribute to that market cap increase. This means that each ada will need to contribute a little less than it would today to reach the market cap target. It’s appropriate to lower the ada target a little in response

So I’ll make an adjustment down below the first nearest psychological level which I think is $4

After all of those considerations…

My 1st Cardano ADA target for the current cycle is $3.90

To be clear… I have more targets that I’ll be sharing over the coming weeks and months. Subscribe now to make sure you don’t miss them!

Tell Me What You Think

What do you think of my first target? I’d love to hear your thoughts, questions, and feedback below!

This newsletter is for entertainment and educational purposes. I’m not a financial advisor and you should do your own research and consult a financial advisor before investing in cryptocurrencies.

Always great content. Thanks for your dedication

Dan, I really liked the educational stuff in this one and the graph about consolidation periods compared to before...helps put it in perspective. Patience is key!