Quote of the Day

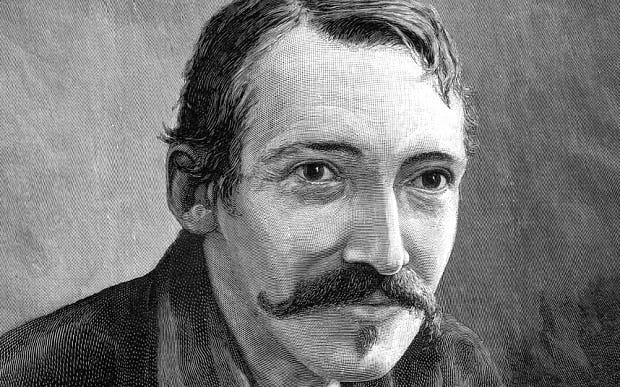

“Don't judge each day by the harvest you reap but by the seeds that you plant."

― Robert Louis Stevenson

This week has been very difficult for a lot of cryptocurrency investors. Measuring the harvest (gains) of each day this week might leave you feeling pretty down.

Maybe that’s not the right measure. Instead, you could judge the seeds that have been planted.

Did you take advantage of the lower prices to add to your portfolio? If so, you planted some seeds.

Did you hold strong with diamond hands through the painful drop? If so, you strengthened your seeds with the conviction it took to do that.

Did you sell your investments? If so, depending on when you sold and if you bought back in, you could have multiplied your seeds.

Worst case scenario, you sold the bottom of the dip and lost some seeds. But even if this happened, you learned about some of the pitfalls of cryptocurrency investing and have valuable lessons to apply in your future seed-planting endeavors.

Key Takeaways from the Past Week

Monday - Foolish Arguments

On Monday, we talked about foolish arguments, how they can quickly get out of hand, and discussed some recent examples that took place on Crypto Twitter.

Wednesday - Greed or Fear

Mid-week, we considered how to prepare for market conditions of extreme greed and fear in light of this week’s market conditions.

Friday - Hang On

By Friday, a lot of new cryptocurrency investors were undoubtedly feeling like they were at the end of their rope. I tried to put the current situation into context that would be helpful to any newcomers.

Technical Analysis

Let’s take a look at the current Cardano ADA chart by itself. On higher timeframes (4 hours and above) ADA continue to hold the important green box as support. That’s encouraging if you want to see the price of ADA rebound as most people do.

Using the trend-based fib extension, and points I discussed in a recent newsletter, we’ve got some targets identified. I continue to think that ADA could make a quick move to the $3.50 - $5.00 level.

That being said, we could consolidate between $1.50 & $2.00 for a period of time or even test to levels much lower than we’re at.

My base case is that we remain in a massive bull market and that all of the over-enthusiasm (leverage) has been let out of the balloon. That was a good thing and I think we’re very close to continuing the move up as a result.

Looking at the crypto majors performance since March 2020 lows…

ADA has held up remarkably well compared to most of the other majors. At this point in time, ADA has provided a 10x return compared to BTC since March 2020 lows! Not too shabby.

Crypto majors are a much safer investment than low market-cap coins and to see this kind of return, even after a massive dump like we’ve seen recently, is really impressive.

It represents the strong case of holding crypto long-term as opposed to attempting to trade it.

Finally we look at our Bitcoin and Ethereum comparisons. Cardano ADA is methodically flipping prior resistance levels to support. This is not a sprint, it’s a marathon or even ultra-marathon.

I do genuinely believe that Cardano will flip Ethereum’s market cap eventually and that it could potentially challenge Bitcoin for the #1 market cap position. It will be fun to watch.

Bonus. This isn’t relevant yet, but in July, Ethereum will begin burning tokens. A lot of tokens. There will be less ETH at a higher price. This will result in ETH price inflation that requires new ways of comparing ETH and ADA.

Around that time, we’ll drop the bottom half of the chart above and begin looking at this ADA/ETH market cap ratio instead.

Hope you all have a great weekend!

Before You Go

Do you like my newsletter? If so, please share it with your friends and family!

Comments are turned on for this post. I’d love to hear your thoughts, questions, feedback, and reflections below!

This newsletter is for entertainment and educational purposes. I’m not a financial advisor and you should do your own research and consult a financial advisor before investing in cryptocurrencies